Find foreclosed homes for sale up to 60% below market value on our foreclosure listings

Foreclosure happens when a homeowner falls behind on their mortgage payments and has no desire or ability to take the steps necessary to avoid the lender repossessing the property. Although foreclosure works differently in each state, there are some basic steps that happen regardless of where you live.

Before we get into the finer details of how the foreclosure process works, it's important to understand the difference between the two types (based on the state in which you live):

Here are the steps of the foreclosure home process in a judicial state:

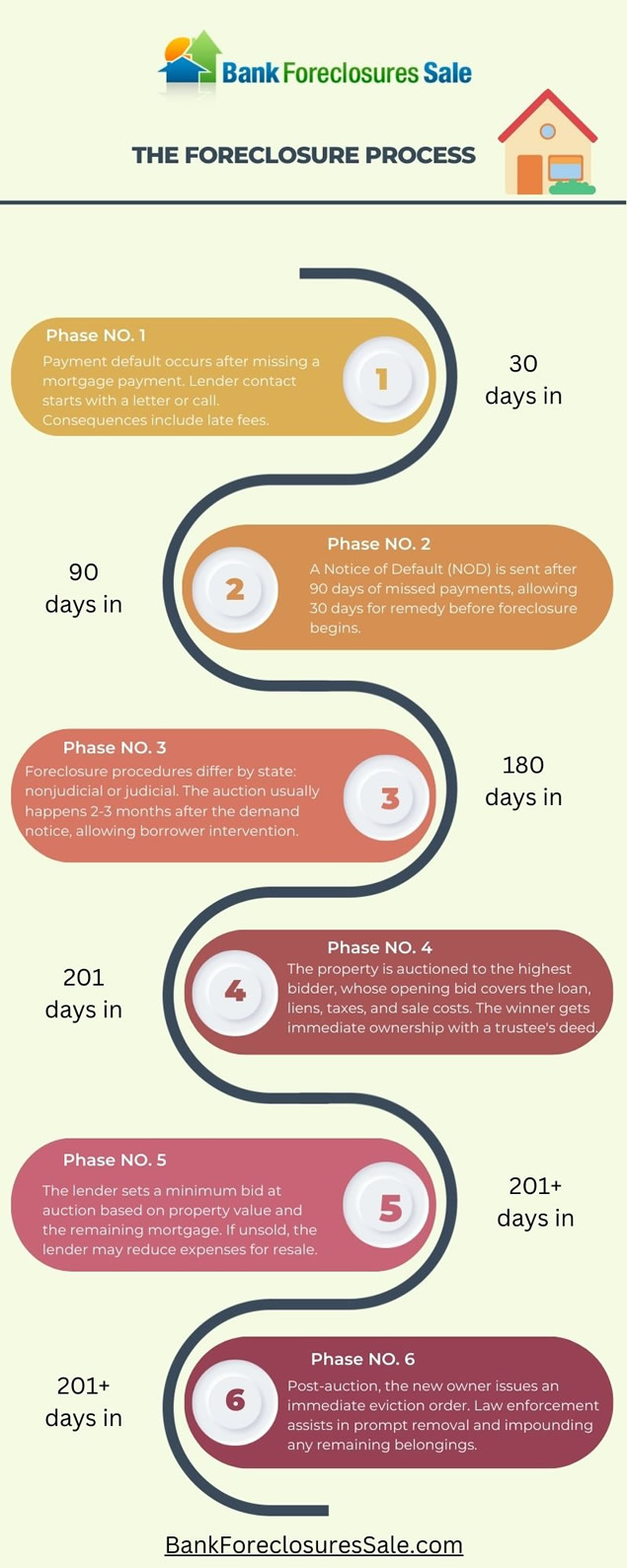

1. You fall behind on your mortgage payments. Although a lender can legally begin the foreclosure process after one missed payment, most wait several months to get a better idea of what is going on.

2. The foreclosure timeline begins with the lender notifying the homeowner of an intent to begin the process. Generally speaking, this consists of a notice being sent to the person, which informs you that foreclosure can be avoided by making missed payments along with any outstanding fees and interest.

3. The lender files a lawsuit. If you are unable or unwilling to make the missed payments, the lender will move forward with the process by going to court and filing a lawsuit.

4. The lender provides notice of the foreclosure lawsuit. This is known as a foreclosure summons and can be delivered to you at home or at work, or anywhere you can be found.

5. You are given time to respond. The summons will explain where the lawsuit stands and what you need to do next. It will also tell you how long you have to respond if you are interested in fighting the lawsuit. This part of the foreclosure process timeline typically lasts between two and four weeks.

You don't have to respond, but it's a good idea if you want to save your home. You might think you don't have a chance, but in reality, it's the lender's responsibility to prove to the court that the foreclosure is justified based on the loan terms.

6. If the judge issues a decision in favor of foreclosure, the lender will send the homeowner an intent to sell letter. As the name suggests, this lets the person living in the home know that the lender plans to sell the property in the near future. In many states, the homeowner still has the chance to make back payments and fees to avoid foreclosure.

7. Foreclosure auction takes place. This usually happens at a local county court house, giving buyers the chance to bid on the property. If nobody is interested, ownership reverts back to the lender.

If you're interested in learning how to buy foreclosures at a courthouse, just click here.

In a non-judicial state, the lender may be able to invoke the "power of sale clause" in a loan agreement to initiate the foreclosure process once the property is in default. No court case is required, but the homeowner should still have some legal protections in terms of the notice they receive and catching up on missed payments before the house is sold at auction. Again, laws will vary in each state.

While the foreclosure timeline differs from state to state, it typically takes anywhere from three to five months for the entire process to be completed. However, if the homeowner responds to the summons with a complaint, the process can drag out even longer.

Local auctions are a good starting point if you are interested in buying a foreclosed home. Additionally, our listing service makes it easy to find properties going to auction and learn about them ahead of time.

We update our database daily with new properties so you have the necessary information to choose which auctions to attend and how to approach the bidding process.

We have helped thousands of people find and buy foreclosures up to 60% below market value.