The 30-year fixed rate mortgage average in the United States has been on a steady rise over the past 12 months.

On February 24, 2022, the average rate was 3.89 percent. As of February 24, 2023, the rate had jumped to 6.50 percent.

Here’s a basic scenario that shows just how much of an impact an increase like this can have on homebuyers.

A $250,000 30-year mortgage with a 3.89 percent interest rate results in a monthly principal payment of $1,178.

A $250,000 30-year mortgage with a 6.50 percent interest rate results in a monthly principal payment of $1,580.

In other words, you’d pay $402 more per month today than 12 months ago for the same loan. That’s a lot of money when calculated over the life of the loan.

How do rising rates impact home buyers and renters?

Regardless of how high rates climb, there will always be people in the market for a new home. However, if history is any indication, rising rates will affect both home buyers and renters in various ways.

Here are several things to watch for.

1. Fewer buyers than before

Here’s a passage from a recent Redfin study that’s sure to open your eyes.

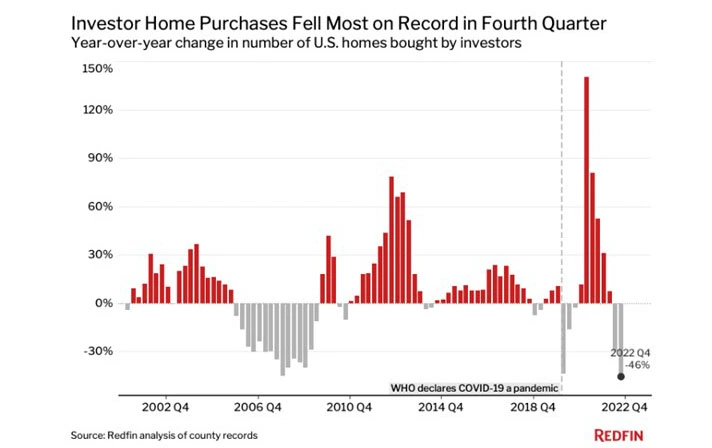

“Investor purchases of U.S. homes fell a record 45.8% year over year in the fourth quarter as the high cost of borrowing money and the prospect of substantial home-price declines made real estate investing less attractive. The second biggest decline occurred in 2008, when investor purchases slumped 45.1% during the subprime mortgage crisis.“

Compared to a year earlier, U.S. home purchases were down 40.8% in the fourth quarter.

Are we heading down the same path as 2008? Only time will tell, but data from the past few months does not look promising for the immediate future of the real estate market.

2. An increase in foreclosures

According to ATTOM, U.S. foreclosure activity doubled in 2022.

Bank repossessions, default notices, and scheduled auctions were reported on 324,237 properties last year. This was an increase of 115 percent over 2021.

There are many reasons for the increase in foreclosure filings, including but not limited to:

- Inflation: Inflation took its toll on consumers in 2022 and its effects are still lingering.

- Rising ARM rates: When ARM rates rise, many homeowners find that they can no longer afford their property.

Here are the five states that experienced the largest number of foreclosure starts in 2022:

- California

- Texas

- Florida

- Illinois

- Ohio

3. A booming rental market

Even though rent prices are on the rise, expect the rental market to remain hot. This is attributed primarily to rising mortgage interest rates.

The scenario above proves that buying a home right now is much more expensive than a year ago. With this, many potential homebuyers will hold off in hopes that rates will dip in the immediate future.

It’s simple: as homeownership costs continue to rise, the rental market will remain strong.

Summary

In addition to the above, rising mortgage rates can have a ripple effect throughout the economy, impacting consumer spending, employment, and inflation.

Keep a close eye on the real estate market as 2023 wears on. It’ll be interesting to see if rates level off and decline or continue to rise.